Forex news for North American trade on October 30, 2020:

Markets:

- Gold up $12 to $1879

- US 10-year yields up 5 bps to 0.87%

- S&P 500 down 63 points to 3246

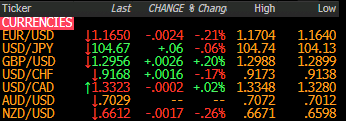

- GBP leads, NZD lags

- WTI crude down 64-cents to $35.54

It was month-end and that added an extra wrinkle to an already-uncertain time. The result was a strong dollar bid into the London fix that was helped along by a risk-averse tone in stocks, particularly tech.

Early on in US trading it looked like sentiment might improve. AUD/USD and other commodity trades jumped and overnight equity futures losses were pared to nearly nothing shortly after the open. But sentiment turned mid-morning and it all came apart.

After the initial 30 pip jump to 0.7072, AUD/USD slowly fell to 0.7029. The kiwi followed the same path and both finished lower after making some solid gains in European trade, in part due to a very strong eurozone GDP number.

The euro mostly held steady but sank into the fix and stayed near the lows of the day for the remainder.

Sterling shrugged off reports of no progress on the major issues in Brexit talks, perhaps concluding that those tough negotiations will wait to the end; perhaps focusing on covid and the election.

The real disconnect in markets was in the Treasury market where bonds sold off hard, led by the long end. Maybe it’s month end related or it could reflect a difference of opinion on the election.