- WTI erases gains, returns to the red in the European session.

- Bearish RSI suggests more downside in the offing.

- OPEC+ outcome much-awaited alongside Powell’s speech.

WTI (futures on NYMEX) drops back below $61, shedding over $1 from daily highs of $61.87, as the bulls turn cautious ahead of the all-important outcome from the OPEC and its allies (OPEC+) meeting and Fed Chair Jerome Powell’s critical speech.

The black gold edged higher earlier this Thursday on reports that the alliance is likely to roll over the oil output cuts next month when compared to expectations of production hike, in light of improved global economic outlook.

Meanwhile, markets await Powell’s take on the recent yield surge, which could have a significant impact on the risk sentiment and the US dollar-sensitive oil.

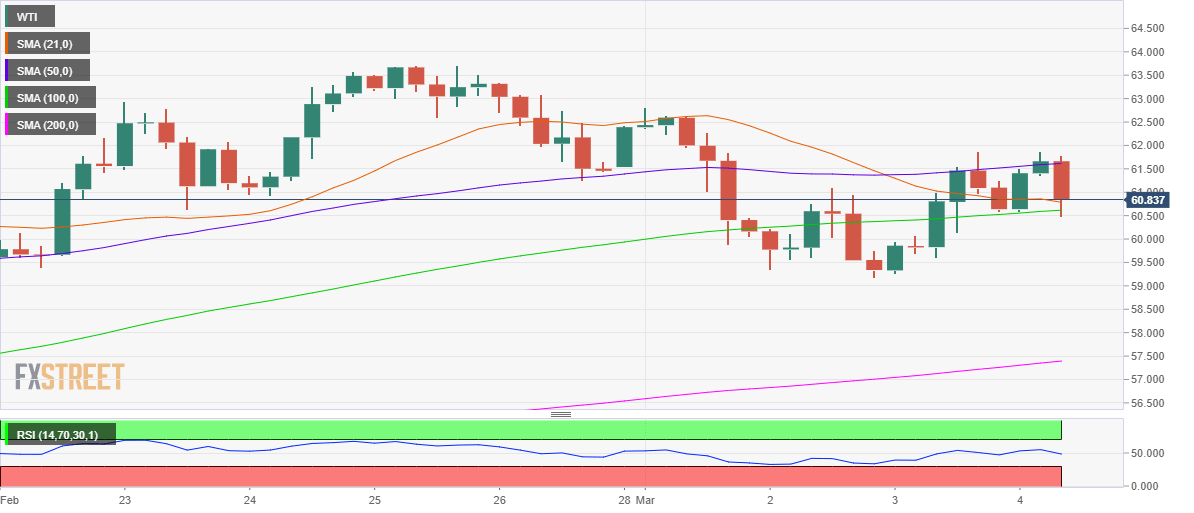

From a technical perspective, the price of the WTI barrel has failed to find acceptance above the horizontal 50-simple moving average (SMA) on the four-hour chart, now at $61.61.

This has prompted the bears to regain control, knocking-off the prices sharply lower to test the fierce support around the $60.65 region. At that level, the bearish 21-SMA coincides with the upward-sloping 100-SMA.

The selling pressure could likely intensify if the black gold delivers a four-hour candlestick closing below the abovementioned cap. Subsequently, a test of the March low at $59.17 cannot be ruled out.

Alternatively, the WTI bulls need a sustained move above the 50-SMA to extending the upside, with the next resistance seen at the $62 round figure.

The Relative Strength Index (RSI) has pierced through the midline and entered the negative territory, suggesting that the downside seems more compelling in the session ahead.

WTI four-hour chart