- NYSEAMERICAN:SENS adds over 20% on Tuesday.

- Senseonics investors continue to await FDA approval for its continuous glucose monitoring device.

- SENS has spiked on no apparent news, SEC filings today show no new info.

Update February 18: Senseonics Holdings Inc (NYSEAMERICAN: SENS) has been changing hands at around $.395 in Thursday’s premarket session, up some 4% – pointing to a bounce after the falls. Shares of the Maryland-based pharma firm have suffered a setback on Wednesday, shedding 9.68% or 51 cents to close at $4.76. Some investors took profits after SENS stock jumped in several waves in early 2020. The most recent drop suggests that if the FDA approves Senseonics’ diabetes monitoring device, there is room for gains rather than a “buy the rumor, sell the fact.” The wait may be nerve-wracking to some, but provides opportunities to others. See all Equities breaking news

Update: Stock trading is never a one-way street and even the Federal Reserve with all its money-pumping is unable to guarantee neverending rises. The S&P 500 is trading lower by some 0.50% after several days that have not seen meaningful downside moves. The same phenomenon is repeated in shares of Senseonics Holdings Inc which are correcting lower without a significant trigger, apart from profit-taking. NYSEAMERICAN: SENS is down some 5%, losing the $5 level. Nevertheless, it is substantially above the 52-week low of $0.35. An FDA approval for its glucose monitoring device is critical for the firm’s fortunes.

Update: Senseonics Holdings Inc (NYSEAMERICAN: SENS) has closed Tuesday’s trade at $5.27, up some 27% on the day. The Maryland-based pharmaceutical firm is still awaiting a seal of approval from the Food and Drugs Administration (FDA) for its diabetes product. Wednesday’s premarket trading is pointing to further advances – another 4.17% to $5.48. It is essential to note that SENS closed January at only $2.37 and that in the last 52 weeks, it was a penny stock – trading under $1. Diabetes has a risk factor for COVID-19 and will outlast the disease that is gripping the world.

Update: Shares in Sensonics Holdings are up 20% in Tuesday’s trading at $4.96. SENS shares have been strong of late as investors await information on FDA approval for its diabetes monitoring product. SEC filings released today don’t appear to be the reason behind the rally as all are from Dec 2020. Roche Finance has reduced its holding in SENS to below 20% to 11.5% as of Dec 2020.

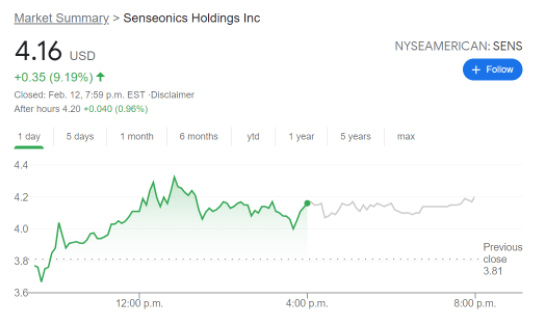

NYSEAMERICAN:SENS finished the week off strong on Friday as the Maryland-based med-tech company extends its bullish run in 2021. During the final trading session before the Presidents Day long weekend, Senseonics added 9.19% to close the week at $4.16, after briefly hitting a new 52-week high price of $4.35 earlier in the day. Shares have already run up by nearly 350% since the start of the year, and retail investors on platforms like FinTwit and Reddit have rallied around the stock.

One of the main reasons that Senseonics has been a popular penny stock amongst traders is the impending FDA approval of its continuous glucose monitoring system. The Eversense CGM system is thought by many to be a disruptive form of technology in the ongoing fight against diabetes, one of the most devastating and commonly diagnosed diseases in the United States. Rather than intermittently testing blood throughout the day, the new Eversense CGM system places a sensor beneath the patient’s skin and updates it in a smartphone app every five minutes. If approved, it will save diabetes patients hundreds or even thousands of needle injections per year for blood tests.

SENS stock forecast

Senseonics’ recent popularity has catapulted the penny stock into the mainstream med-tech conversation and it has gone from one of Reddit’s meme stocks to a $1.5 billion market cap. Senseonics has already announced that it expects to receive FDA approval for the Eversense CGM system by the second quarter of 2021, which accounts for much of the stock’s recent success.