GBP/USD Forecast: Imposition of third lockdown in UK could cap the upside

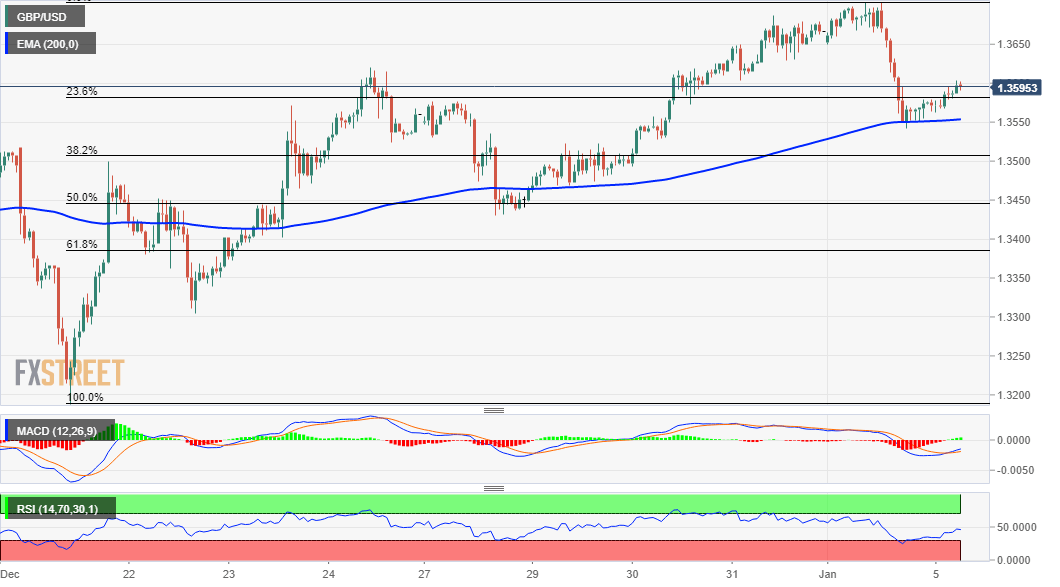

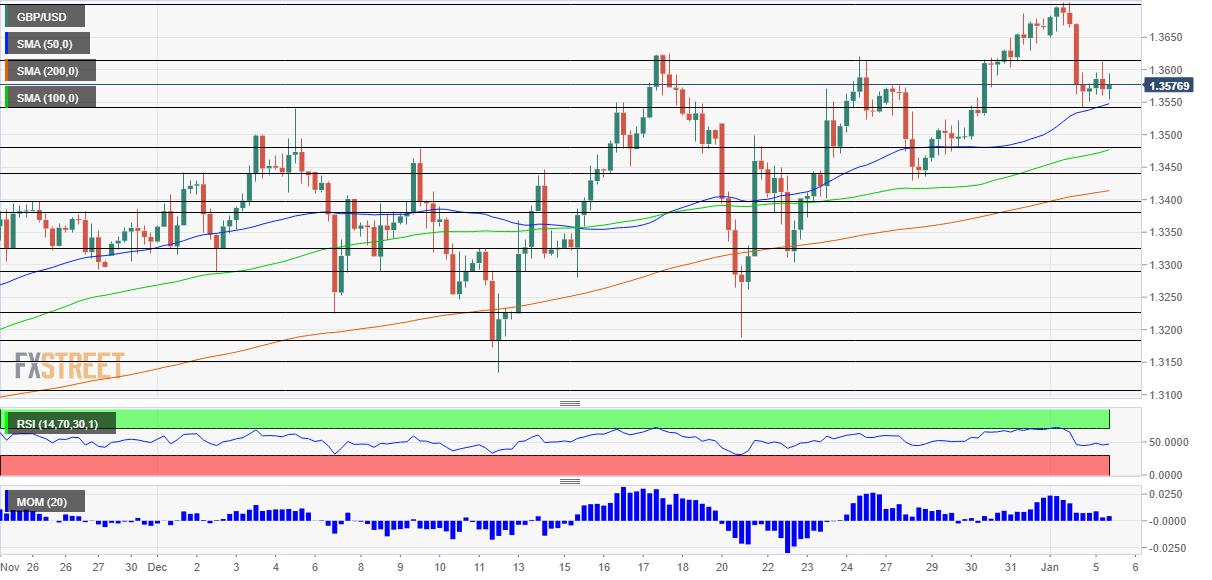

The GBP/USD pair witnessed a dramatic turnaround on the first trading day of 2021 and retreated over 160 pips from the 1.3700 mark, or fresh 32-month tops. The early positive move was exclusively sponsored by sustained US dollar selling bias and seemed rather unaffected by concerns about the exclusion of the UK services sector from the Brexit agreement. That said, worries about an unprecedented level of COVID-19 infection in the UK kept a lid on any further gains for the major, rather prompted some aggressive selling at higher levels. In fact, infections rose by a record 58,784 on Monday, marking the seventh-straight day of more than 50,000 new confirmed coronavirus cases.

The intraday selling bias aggravated further after UK Prime Minister Boris Johnson imposed a third national lockdown until mid-February to curb the continuous surge. The move was predicted to slow the economic recovery and prompt the Bank of England to ease monetary policy further, which, in turn, took its toll on the British pound. Apart from this, doubts about the effectiveness of vaccine on a new coronavirus strain coming from South Africa and uncertainty about the runoff elections in Georgia tempered enthusiasm. Read more…

GBP/USD Forecast: Stering ready to rally on vaccine optimism, as harsh lockdown locked into price

No more tiers – the whole of the UK has entered a severe lockdown reminiscent of the spring, which includes the shuttering of schools. Prime Minister Boris Johnson asked the nation to stay at home as hospitals are overwhelmed by the rapid spread of COVID-19.

There is growing evidence that the B.1.1.7 virus strain is responsible for the accelerated spread, also prompting many countries to ban travel to and from the UK. To add insult to injury, some worry that the South African variant could even be resistant to vaccines. Further information is needed. Read more…

GBP/USD surrenders intraday gains, slide back closer to mid-1.3500s

The GBP/USD pair quickly retreated over 50 pips during the early European session and has now dropped to the lower end of its daily trading range, just above mid-1.3500s.

Following the previous day’s rejection slide from the 1.3700 mark, or fresh 32-month tops, the pair regained positive traction on Tuesday amid the emergence of some fresh selling around the US dollar. In fact, the greenback struggled to attract any safe-haven demand and remained depressed near two-and-half-year lows through the first half of the trading action on Tuesday. Read more…