Daily technical and trading outlook – GBP/USD

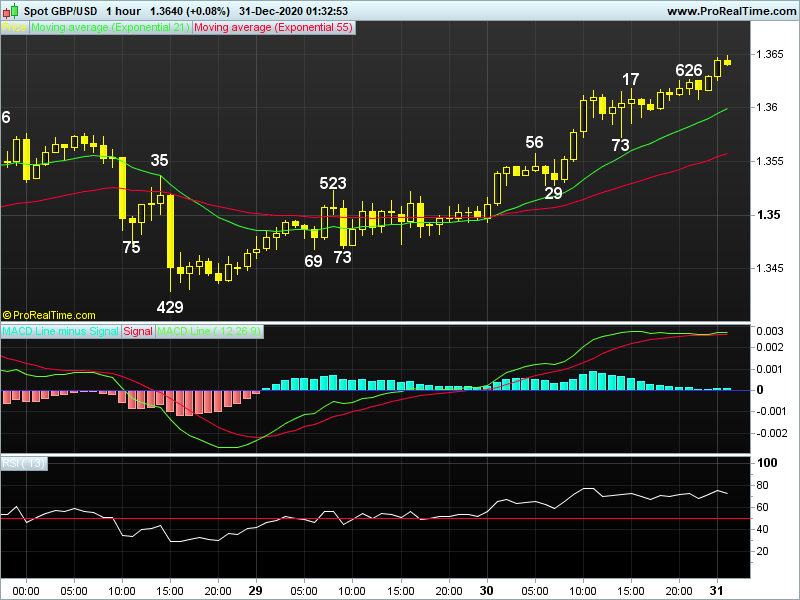

GBP/USD – 1.3641.. Sterling was the strongest G4 currency vs usd y’day, price met renewed buying at 1.3494 (AUS) n climbed steadily to 1.3615 in Europe , despite a brief pullback to 1.3573 in NY, cable hit 1.3626 at the close.

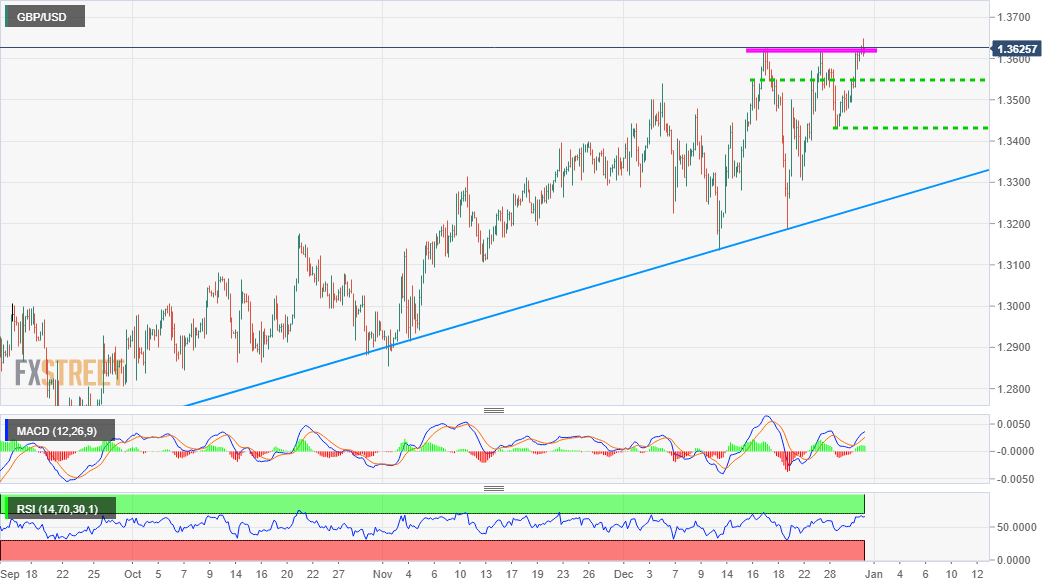

On the bigger picture, despite cable’s brief break of 2016 post-Brexit low of 1.1491 to a near 35-year trough of 1.1412 in mid-Mar on safe-haven usd’s demand following free fall in global stocks, sterling’s rally to as high as 1.28 12 (Jun) on broad-based usd’s weakness, then to an 8-month peak of 1.3482 on the 1st day in Sep suggests a major bottom is in place. Although cable has retreated to 1.3189 last Mon after rally abv 2019 high at 1.3516 to a fresh 2-1/2 year peak at 1.3625, Thu’s rebound to 1.3620 as a Brexit deal was reached signals pullback has ended n abv 1.3625 would extend to 1.3680/90. On the downside, only a daily close below 1.3305 would risk weakness back to 1.3189, break, 1.3135. Read more…

GBP/USD climbs further beyond mid-1.3600s, fresh 31-month tops

The buying interest around the British pound picked up pace during the early European session and pushed the GBP/USD pair further beyond mid-1.3600s, or fresh 31-month tops.

The pair built on the previous day’s strong positive move back above the 1.3600 mark and gained some follow-through traction for the third consecutive session on Thursday. The sterling was supported by the passage of post-Brexit trade deal in the UK Parliament. This, coupled with sustained US dollar selling bias, provided an additional boost to the GBP/USD pair. Read more…

GBP/USD Analysis: Bulls turn cautious amid further COVID-19 restrictions in UK

The GBP/USD pair gained some strong follow-through traction on Wednesday and jumped back above the 1.3600 mark amid the heavily offered tone surrounding the US dollar. Investors looked past the effective rejection of a measure to raise the direct payments to most US households to $2,000 and remain convinced about the likelihood of additional US financial aid. This, along with hopes for a strong global recovery in 2021, remained supportive of the upbeat market mood. The already strong risk sentiment got an additional boost after UK regulators approved the use of AstraZeneca/Oxford coronavirus vaccine. This, in turn, was seen as a key factor that continued undermining the safe-haven greenback and driving the pair higher.

The British pound largely shrugged off an unprecedented level of COVID-19 infection across the UK. Several areas of the country went into the toughest tier-4 restrictions on Wednesday after the UK reported over 50,000 news cases for the second day in a row. The positive momentum also seemed rather unaffected by the fact that the Brexit agreement excluded the crucial services sector, which makes up 80% of the British economy. Read more…