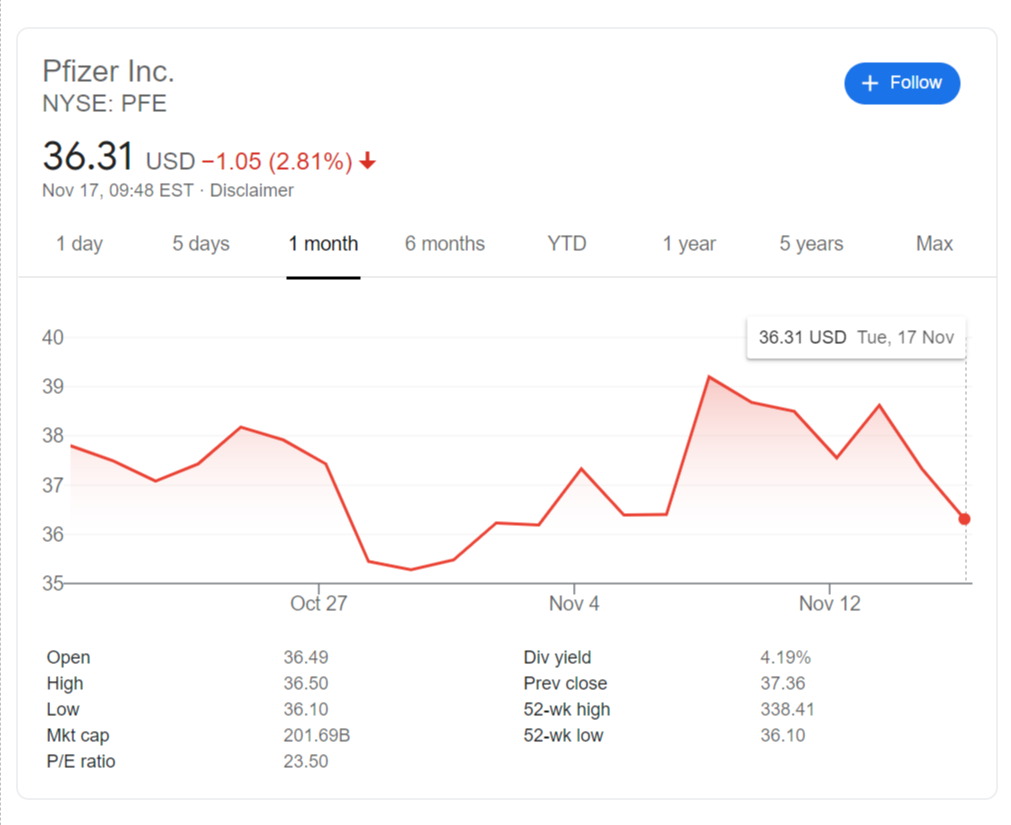

- NYSE: PFE is falling again, responding to coronavirus vaccine competition.

- Pfizer Inc’s cheaper immunization cost may help it get an edge.

- A COVID-19 vaccine distribution pilot in four states could also help the firm gain traction.

Being first does not mean staying on top – Pfizer Inc (NYSE: PFE) and BioNTech SE (BNTX) stunned the world by announcing 90% efficacy in their COVID-19 vaccine candidate. However, as discussed at the time, other initiatives were breathing down its neck – and using the same Messenger RNA technology.

Pfizer CEO Abert Bourla and BioNTech CEO Uğur Şahin had little time to celebrate. Exactly a week after the big news, Moderna Inc (NASDAQ: MRNA) released its own preliminary results showing an efficacy rate of 94.5%, beating Pfizer. That is only one advantage that Moderna CEO Stephane Stéphane Bancel has over his rivals.

See MRNA Stock News: Moderna has room to rally as coronavirus vaccine has five advantages over Pfizer’s

Other coronavirus stocks may also outshine NYSE: PFE when the pharmaceutical firms behind them publish results from their Phase 3 immunization trials. AstraZeneca (LON: AZN) and Johnson & Johnson (NYSE: JNJ) also use mRNA technology to teach the body how to fight covid.

Nevertheless, the Pfizer/BioNTech solution has one significant advantage over Moderna and perhaps other coronavirus contenders – cost. According to the Guardian, Pfizer’s price tag is around £30 for two doses, while Moderna’s solution is set to cost up to £45 for the same treatment. That could mark a difference for governments aiming to vaccinate large populations.

Another edge that the New York-based pharma giant could have is an early distribution pilot. It will begin shipping doses to four distinct American states – Rhode Island, Tennessee, Texas, and New Mexico. Working with different types and densities of the population will help the firm down the road.

NYSE: PFE Stock

NYSE: PFE is down around 2.8% on Tuesday, extending its falls from Monday, when Moderna came out with its news. At the time of writing, shares are changing hands at just above $36. It has pared its gains triggered by its own covid vaccine announcement. Support awaits at $35 and resistance at around $40.