Gold price drops amid stimulus and poor data

The price of gold has declined further amid incoming U.S. President Joe Biden’s fiscal stimulus and poor economic data, which is a bearish sign.

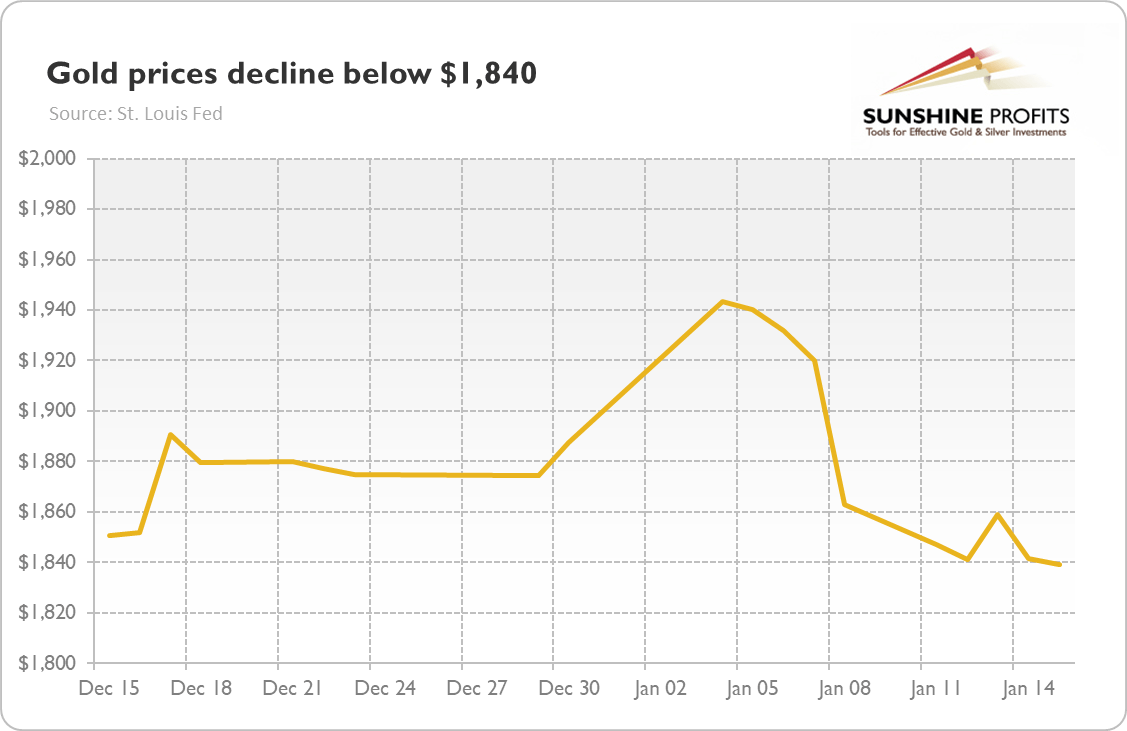

The weakness in the gold market continued last week. As the chart below shows, the London P.M. Fix declined below $1,840 last Friday (the price of the yellow metal later declined even further, i.e., below $1,830). Read more…

Gold Price Analysis: XAU/USD challenges 200-DMA on the road to recovery, Yellen eyed

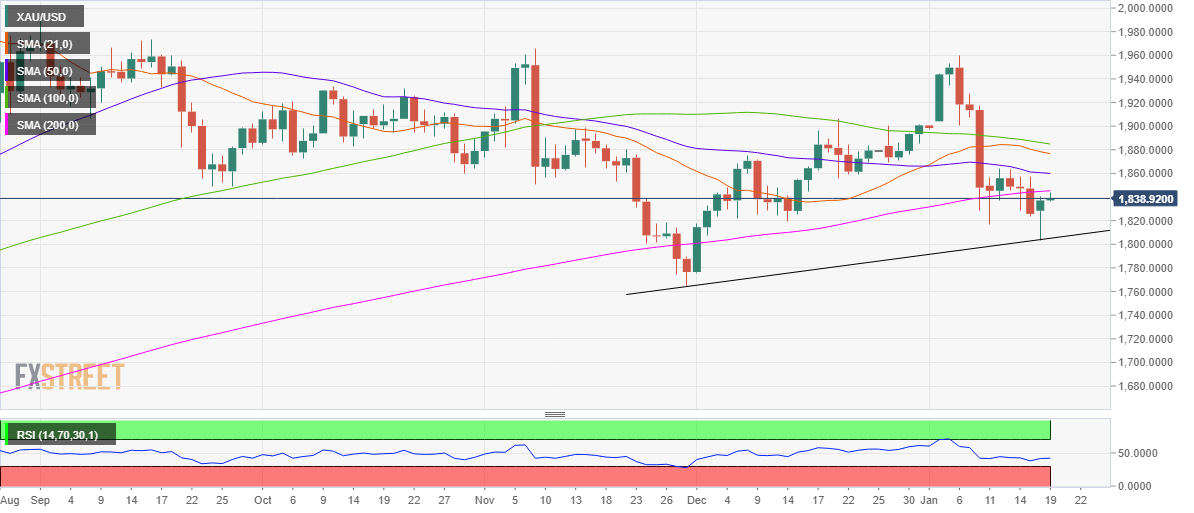

Gold (XAU/USD) is struggling to extend Monday’s impressive bounce from seven-week lows of $1803, as the 200-daily moving average (DMA) appears to be a tough nut to crack for the bulls.

Investors await US Treasury Secretary nominee Janet Yellen’s testimony due later in the NA session for fresh direction. Read more…

Gold Price Analysis: XAU/USD recovers further from multi-week lows, climbs to $1845 region

Gold edged higher during the early European session and climbed to two-day tops, around the $1845 region in the last hour.

The precious metal gained positive traction for the second consecutive session on Tuesday and built on the overnight goodish rebound from the vicinity of the $1800 mark, or seven-week lows. The uptick was exclusively sponsored by a modest US dollar pullback from nearly one-month tops, which tends to benefit the dollar-denominated commodity. Read more…