- Gold awaits a breakout from the recent trading range.

- XAU/USD remains locked between 50-DMA and 200-DMA.

- All eyes on the Fed decision and a potential US fiscal stimulus deal.

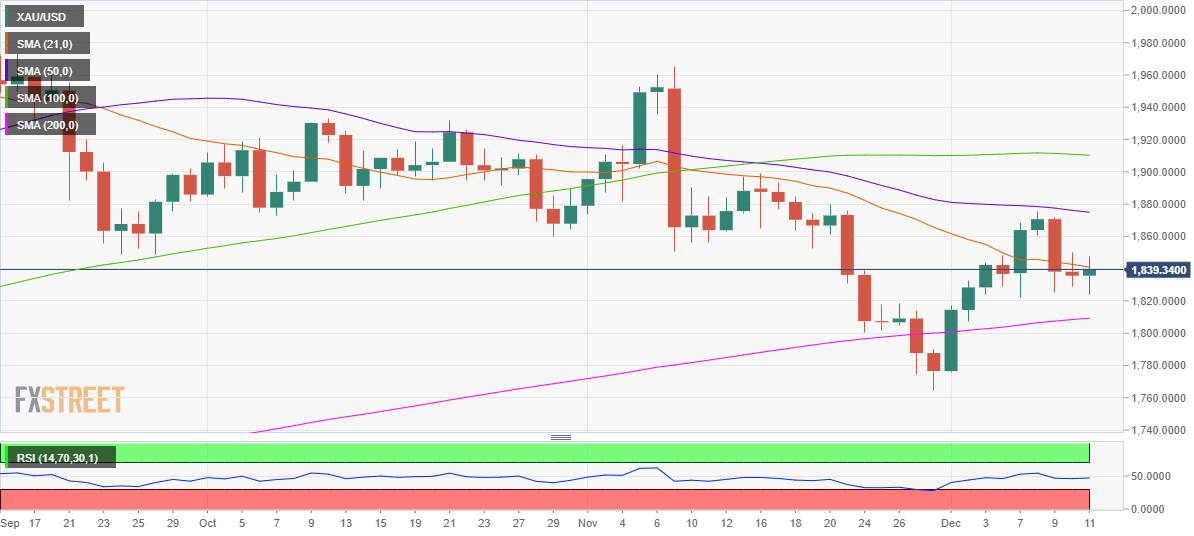

Gold (XAU/USD) resumed its bearish momentum following a brief recovery from multi-month lows sub-$1800 in the last week.

The sellers returned after the metal faced rejection at the 50-daily moving average (DMA), now at $1875.

On Wednesday, gold fell as much as 1% to near the $1825 region and spent the rest of the week meandering near the latter, with the upside attempts capped by the 21-DMA of $1841.

Gold Price Chart: Daily

XAU/USD’s daily chart clearly shows that the price continues to oscillate in a defined range. Acceptance above the 50-DMA is critical to reviving the recovery momentum from four-month troughs of $1765.

Meanwhile, the 200-DMA support at $1809 is the level to beat for the bears. The 14-day Relative Strength Index (RSI) settled the week at 47.01, keeping the odds for additional downside alive.

Further, a failure to deliver a weekly closing above the critical short-term hurdle of 21-DMA, also suggests that more declines could be in the offing.

However, the Fed’s final monetary policy decision of this year and a likely US fiscal stimulus deal could have a significant impact on the gold price action in the week ahead.