- NYSE: GME has kicked off Wednesday’s trading with a surge of some 20% to above $100.

- Bargain-seekers are jumping on GameStop Corp after it lost 60%.

- Retail traders on WallStreetBets have been split over the move to silver.

Update: GameStop (NYSE: GME) is for a second consecutive day of moderate gains – an increase of roughly 3% to $96 after closing Monday’s trade up by 2.68% at $92.41. While moves of several percentage points may seem like handsome profits for seasoned traders, they are far from what the videogame stock has been experiencing in recent weeks. One of the reasons for the increase, as described below, is Robinhood’s relaxation of its limits related to GME. Will the online platform be able to cub trading for much longer? Treasury Secretay Janet Yellen is set to meet financial services regulators later on Thursday, and any potential unleashing of restrictions could trigger higher volatility.

Update: In GameStop Corp. (NYSE: GME), the price action is now generally muted as all the buyers have cashed in and the market takes a breather.

However, that is not to say that there may not be a resurgence in the retail sector seeking to target funds that may well have taken the courage to short the stock once again on the bearish fundamentals that had seen the stock in steady decline since 2014 tops of $57 a share.

Social investing is here to stay

In a new and powerful commercial trend driven by Millennials and Gen Zers, the retail sector has proven that it can take on the ‘big boys’.

The news will have spread to attract new amateurs into the space seeking to make an easy buck as those out of work seek alternative ways to make money from home. This may mean the next round of buyers could be even greater, for the fear of missing out, (FOMO).

However, whether Gamestop will be their best choice is yet to be known, and the social media space will perhaps be the giveaway on what will be targetted next.

Meanwhile, from a fundamental basis, GameStop Corp today announced that it has appointed Matt Francis to the newly-created role of Chief Technology Officer who will start on February 15, 2021. Most recently, he was an Engineering Leader at Amazon Web Services.

Additionally, two other executives have been hired:

- Kelli Durkin, Senior Vice President of Customer Care – Ms. Durkin, who previously served as Chewy’s Vice President of Customer Service, has a start date of March 1, 2021. She helped establish the world-class customer service operation that positioned Chewy to achieve a Net Promoter Score of 86 in 2018. In her new role, Ms. Durkin will oversee all customer service and engagement initiatives at GameStop.

- Josh Krueger, Vice President of Fulfillment – Mr. Krueger, who previously held senior fulfillment roles at Amazon, Walmart, and QVC, has a start date of March 1, 2021. In his new role, Mr. Krueger will oversee the management of e-commerce fulfillment centers,

… the company wrote on its website on 3rd Feb.

At the time of writing, the stock is trading at $108 and is up some 20% on the day as the price attempt to recover from the lows of $85.25 following a dip from the highs of $113.40.

End of update.

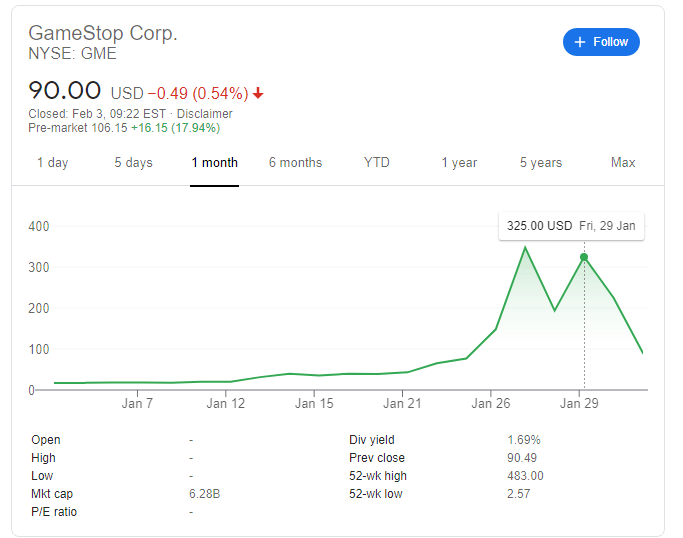

GameStop Corp. (NYSE: GME), the poster child of the recent market craze, has been staging an impressive recovery with a jump above $100. Shares of the videogame company collapsed from the high of $483 last week – and close of $325 on Friday – to $90 at the end of Tuesday’s session.

GME News: Three reasons to recover

There are three reasons for the recovery. First, bargain-seekers have been jumping on GME, seeing genuine fundamental reasons to rise amid a revamped business plan for the firm. That was the initial reason to rise, before the Reddit frenzy.

Second, the trend toward short-squeezing silver – a market worth 200 times GameStop – has been splitting the community. After XAG/USD jumped above $30, it is back down.

Third, RobinHood relaxed its limitations related to buying and selling stocks. While the online trading platform – that had to raise funds in a firesale – still imposes restrictions, it is now easier for traders to buy new stocks.