The rallies of Euro and Swiss Franc continue today, with much help by buying in crosses, in particular against Sterling and Aussie. The latter two are currently the worst performing ones, with Sterling as the weakest for the week too. Dollar is actually performing not too badly, down just against Euro and Franc. Main focus now turn to FOMC minutes but we’re not expecting any deviation from recent comments from Fed officials. That is, recovery would be strong in second half, but it’s pre-mature to even start considering stimulus exit. Inflation this year is transitory while rise is treasury yields reflects brighter outlook.

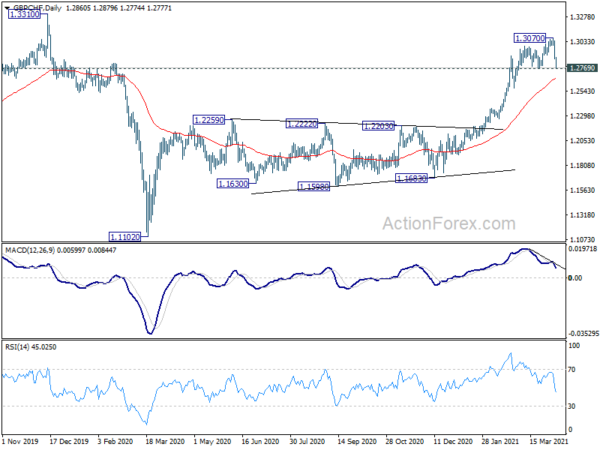

Technically, GBP/USD’s break of 1.3808 minor support now suggests that recovery from 1.3669 has completed at 1.3917. Correction from 1.4240 is now in progress and could extend towards 1.3482 key resistance turned support. EUR/GBP is now inches below 0.8644 resistance. Break will at least confirm short term bottoming and bring stronger rebound. GBP/CHF is also inch above 1.2769 support and break will confirm the start of a short term correction towards 55 day EMA (now at 1.2668) and below.

In Europe, currently, FTSE is up 0.74%. DAX is down -0.33%. CAC is down -0.18%. Germany 10-year yield is down -0.0008 at -0.321. Earlier in Asia, Nikkei rose 0.12%. Hong Kong HSI dropped -0.91%. China Shanghai SSE dropped -0.10%. Singapore Strait Times dropped -0.37%. Japan 10-year JGB yield dropped -0.0104 to 0.101.

US trade deficit widened to USD 71.1B in Feb, as exports and imports fell

US goods and services export dropped -0.7% mom to USD 258.3B in February. Goods and services exports dropped -2.6% mom to USD 187.3B. Trade deficit widened to USD 71.1B, from January’s USD 67.8B, larger than expectation of USD 70.2B.

Trade deficit with China rose USD 3.1B to USD 30.3B. Deficit with Canada rose USD 2.2B to USD 4.0B. Deficit with Mexico dropped USD -5.1B to USD 6.8B.

Fed Kaplan: We’re not out of the woods yet

Dallas Fed President Robert Kaplan said in a WSJ interview, “there’s reason to be optimistic about the future.” But he emphasized that “we’re not out of the woods yet”. And, “reducing stimulus when the pandemic abates and more economic progress is made will help keep the recovery going

“When we’re in the middle of a crisis, we should be aggressively using our tools, so I agree with what we’re doing now in terms of asset purchases and stance of policy generally,” Kaplan said

ECB Knot: There is very good reason to expect robust recovery in H2

ECB Governing Council member, Dutch central bank chief Klaas Knot, said “there is very good reason to expect a robust recovery in the second half of the year.” And, “if the economy develops according to our baseline, we will see better inflation and growth from the second half onwards.”

“In that case, it would be equally clear to me that from the third quarter onwards we can begin to gradually phase out pandemic emergency purchases and end them as foreseen in March 2022,” he added.

Knot was also comfortable with higher nominal rates, if they are “entirely due to higher inflation expectations”. “To the extent that higher nominal yields are driven by better inflation and growth prospects, to me that’s entirely benign.”

Eurozone PMI composite finalized at 53.2, increasingly adapted to life with the virus

Eurozone PMI Services was finalized at 49.6 in March up from February’s 45.7. PMI Composite was finalized at 53.2, up from prior month’s 48.8, highest level since last July. Looking at some member states, Germany PMI Composite was finalized at 57.3, a 37-month high. Ireland PMI Composite rose to 8-month high at 54.5, Italy rose to 8-month high at 51.9, Spain rose to 8-month high at 50.1, France rose to 7-month high at 50.0.

Chris Williamson, Chief Business Economist at IHS Markit said: “The survey therefore indicates that the economy has weathered recent lockdowns far better than many had expected, thanks to resurgent manufacturing growth and signs that social distancing and mobility restrictions are having far less of an impact on service sector businesses than seen this time last year. This resilience suggests not only that companies and their customers are looking ahead to better times, but have also increasingly adapted to life with the virus.”

UK PMI services finalized at 56.3, composite at 56.4

UK PMI Services was finalized at 56.3 in March, up sharply from February’s 49.5. That’s also the first expansionary reading above 50 since October 2020. PMI Composite was finalized at 56.4, up from prior month’s 49.6, best reading for six months.

Tim Moore, Economics Director at IHS Markit: “Around two-thirds of the survey panel forecast an increase in output during the year ahead, which reflected signs of pent up demand and a boost to growth projections from the successful UK vaccine rollout…. There were further signs that strong cost pressures have spilled over from manufacturers to the service economy, especially for imported items.”

Australia AiG construction rose to 61.8, record high

Australia AiG Performance of Construction rose 4.4 pts to 61.8 in March, hitting a record high. Also, the indexes for new orders, employment and supplier deliveries all hit record highs.

HIA Economist, Angela Lillicrap, said: “Activity is being driven to new heights by a combination of the HomeBuilder program, record low interest rates and shifts in population away from apartments and capital cities towards detached housing and regional areas. The record volume of work will see home building absorb workers from across the economy in 2021 and into 2022. The outlook for multi-units, unfortunately, will remain poor in the absence of overseas migrants, students and tourists.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1821; (P) 1.1850; (R1) 1.1903; More….

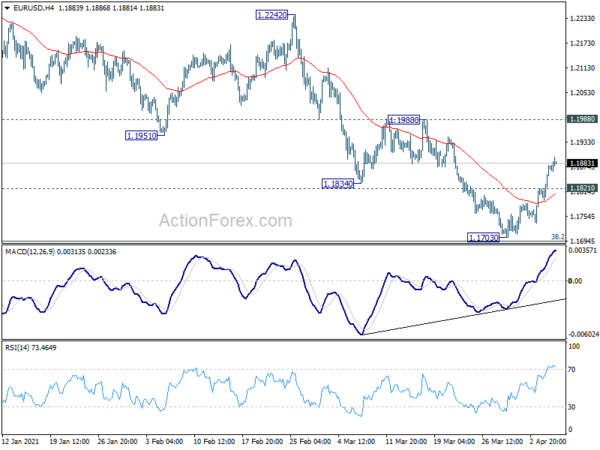

Intraday bias in EUR/USD remains on the upside, as rebound from 1.1703 short term bottoming is extending. Break of 1.1988 resistance will will add to the case that whole correction from 1.2348 has completed. Further rally would then be seen to 1.2242 resistance for confirmation. On the downside, however, break of 1.1821 minor support will turn bias back to the downside for 38.2% retracement of 1.0635 to 1.2348 at 1.1694.

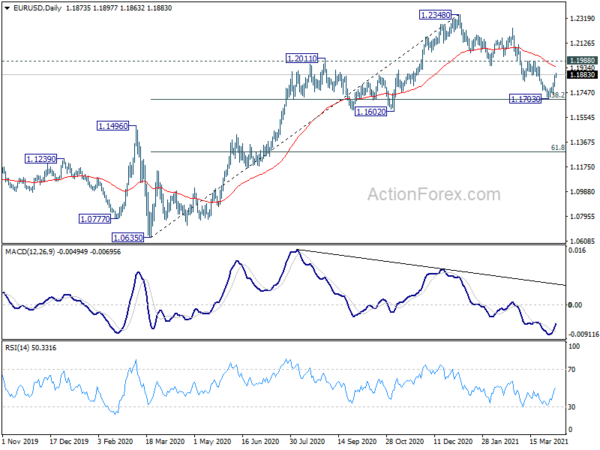

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. However, sustained break of 1.1602 will argue that whole rise from 1.10635 has completed. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Mar | 61.8 | 57.4 | ||

| 05:00 | JPY | Leading Economic Index Feb P | 99.7 | 100.7 | 98.5 | |

| 07:45 | EUR | Italy Services PMI Mar | 48.6 | 49.1 | 48.8 | |

| 07:50 | EUR | France Services PMI Mar F | 48.2 | 47.8 | 47.8 | |

| 07:55 | EUR | Germany Services PMI Mar F | 51.5 | 50.8 | 50.8 | |

| 08:00 | EUR | Eurozone Services PMI Mar F | 49.6 | 48.8 | 48.8 | |

| 08:30 | GBP | Services PMI Mar | 56.3 | 56.8 | 56.8 | |

| 12:30 | CAD | Trade Balance (CAD) Feb | 1.0B | 1.3B | 1.4B | 1.2B |

| 12:30 | USD | Trade Balance (USD) Feb | -71.1B | -70.2B | -68.2B | -67.8B |

| 14:00 | CAD | Ivey PMI Mar | 62.5 | 60 | ||

| 14:30 | USD | Crude Oil Inventories | -0.9M | |||

| 18:00 | USD | FOMC Minutes |