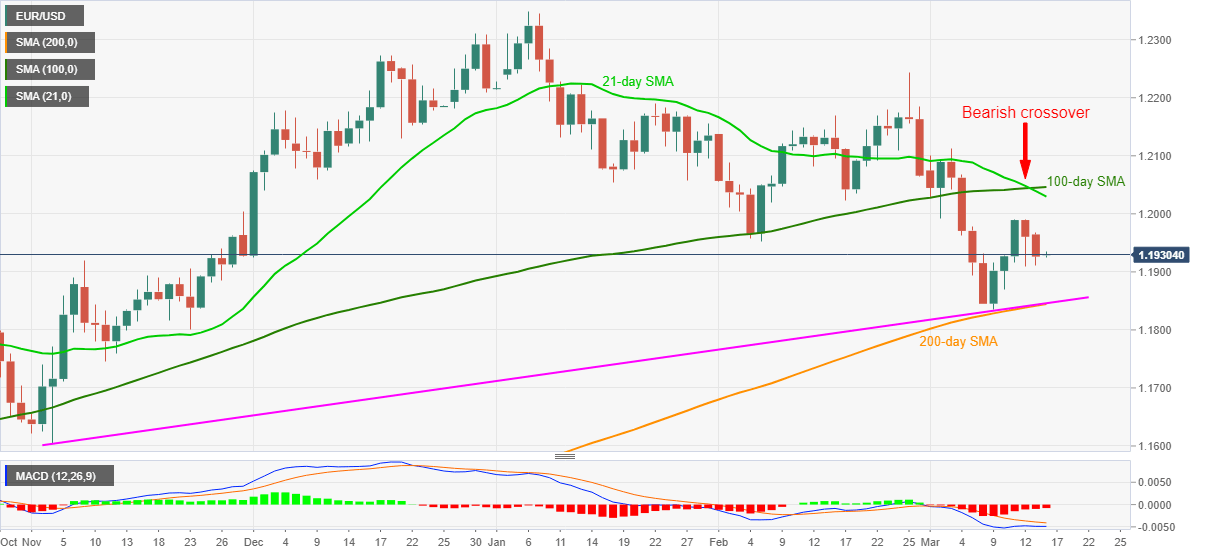

- EUR/USD picks up bids inside immediate range between 1.1910 and 1.1940.

- Bearish MACD, 100-day SMA cross over 21-day SMA favor sellers.

- 200-day SMA, ascending trend line from early November offers strong support.

EUR/USD seesaws inside a 30-pip trading range above 1.1910, currently up around 1.1930, during Tuesday’s Asian session. In doing so, the quote struggles for a clear direction following the two-day losing streak.

Although EUR/USD sellers are catching a breather, Friday’s downside break of 21-day SMA over 100-day SMA, coupled with bearish MACD, suggests the pair’s further weakness.

As a result, the 1.1900 threshold can offer immediate support to the EUR/USD sellers. However, a convergence of 200-day SMA and a 4.5-month-old rising trend line, currently around 1.1845, will be a tough nut to crack for the bears.

Meanwhile, corrective pullback needs to regain the 1.2000 psychological magnet before defying the bearish crossover while rising past-100-day SMA level of 1.2045.

Following that, EUR/USD buyers can aim to refresh the monthly high of 1.2113.

EUR/USD daily chart

Trend: Further weakness expected