- EUR/JPY bulls face prospects of a significant correction ahead od the target.

- The Momentum is strong with the pair, as the US dollar pulls back.

The US dollar has stalled and the euro has corrected higher.

As per the prior analysis, EUR/JPY Price Analysis: Bulls need a break, well, that is exactly what they got.

Prior analysis

”Bulls need to get over the initial resistance and the 21-moving average.”

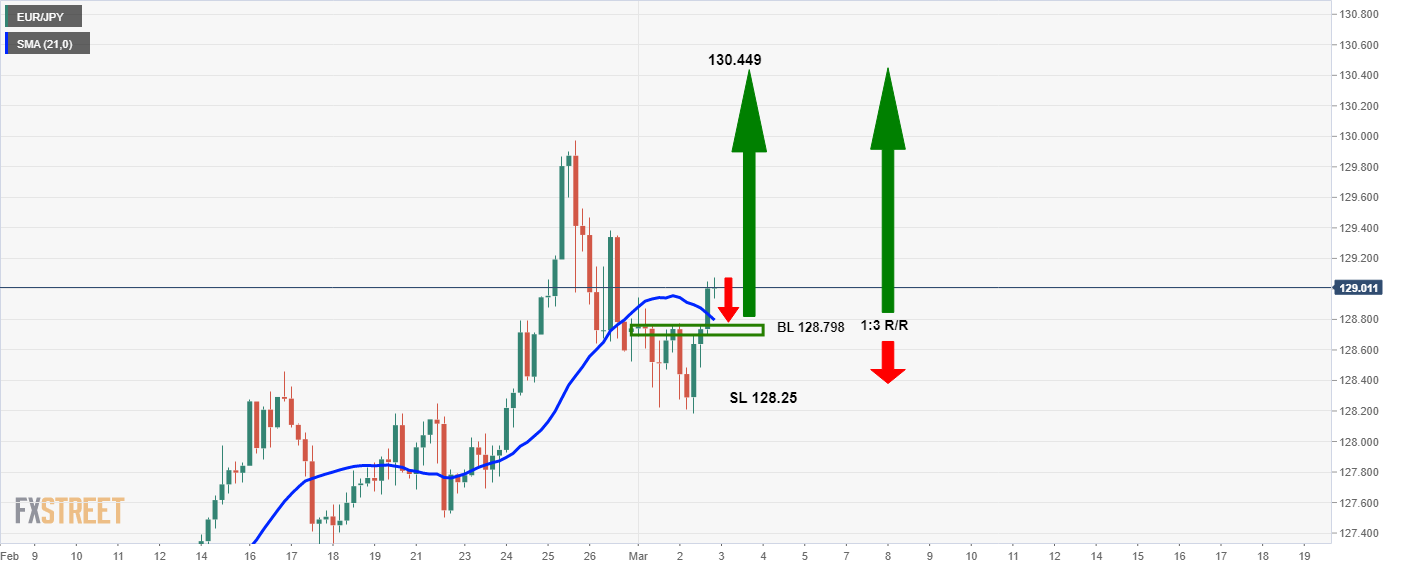

4-hour chart

On a retest of the 21-moving average and/or the structure, a buy limit order will open a position for a 1:3 risk to reward set up to target the 130.40s.

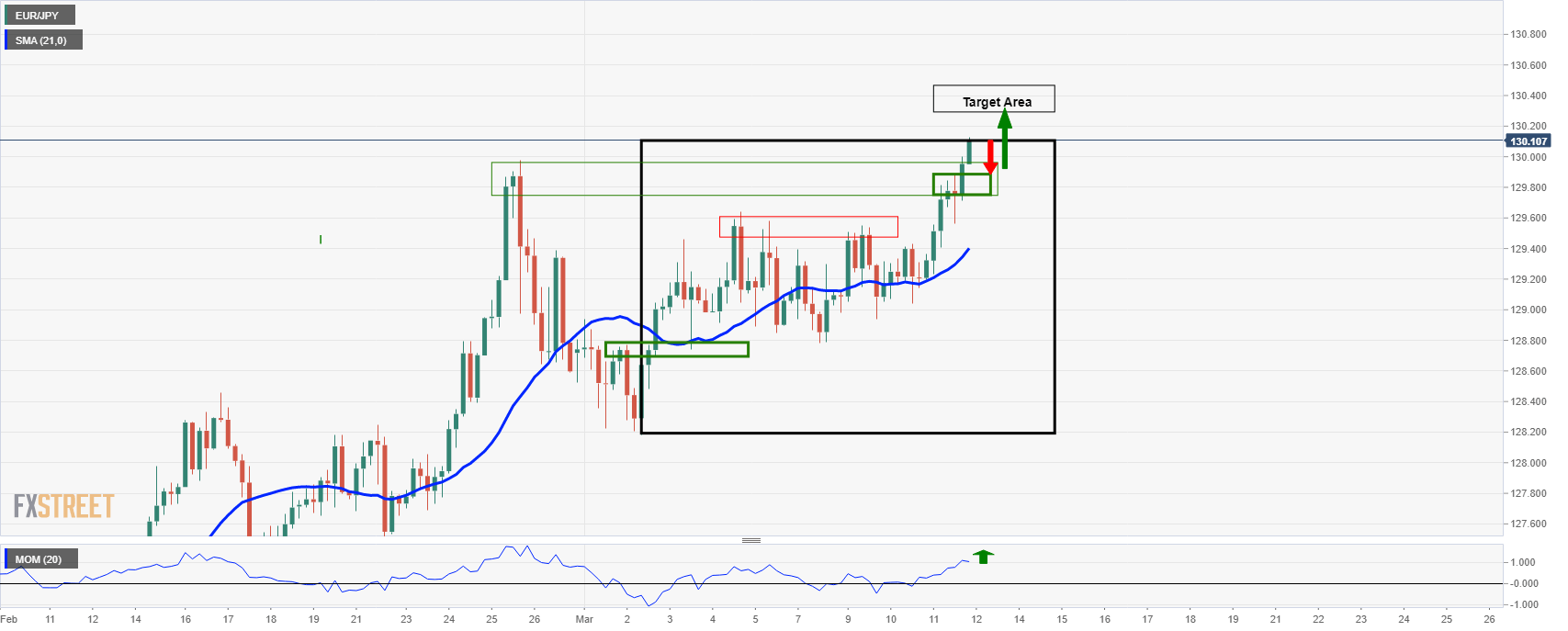

Live market, 4-hour chart

Following a number of days stuck in a sideways chop, the price has finally broken out and north of all structure within strong Momentum.

While the price is still some way off, the original thesis was based on the longer-term charts, as follows and would be expected to continue to the target:

Prior analysis

EUR/JPY Price Analysis: Bulls seeking daily upside continuation

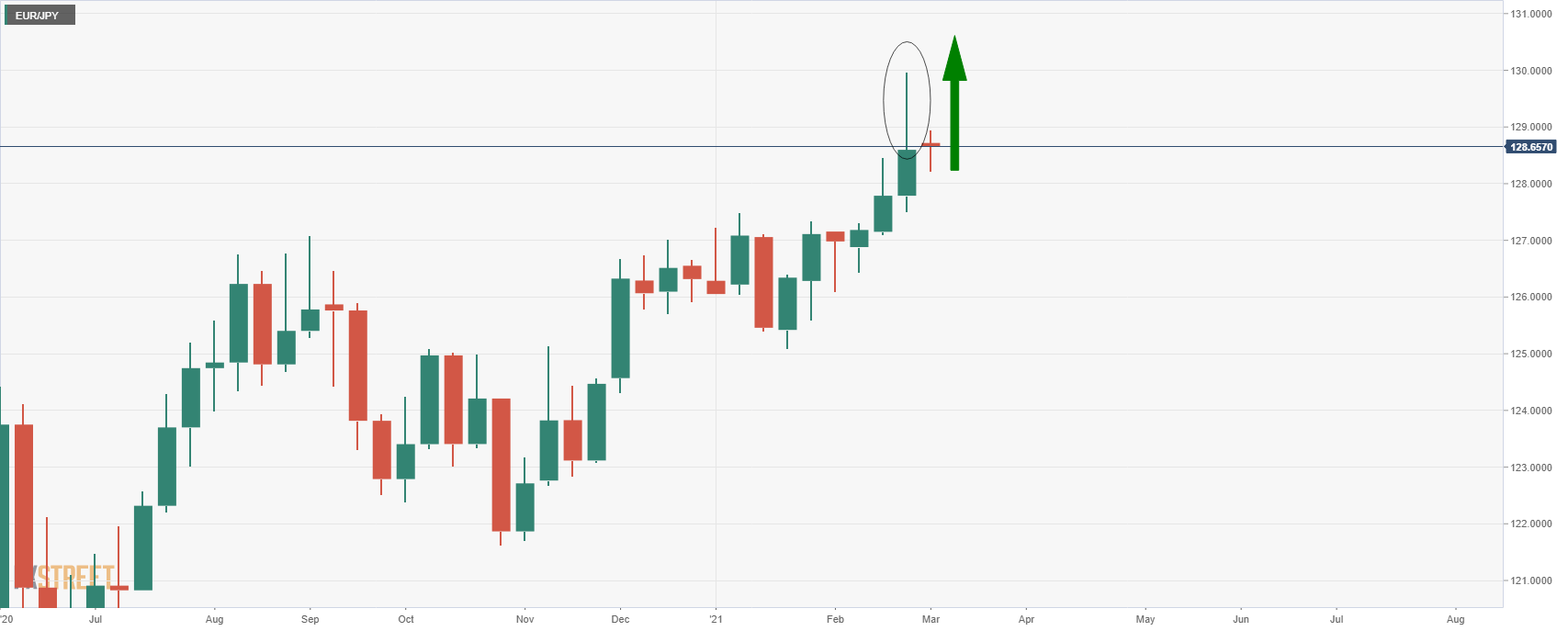

The price extended to the upside but failed to maintain the bid, leaving a compelling wick on the weekly chart as follows:

This wick would be expected to be filled in as it merely represents the daily correction to prior resistance which has held the initial tests of a decelerating retracement…

Live market, weekly chart

As can be seen, the market has indeed filled in the wick.

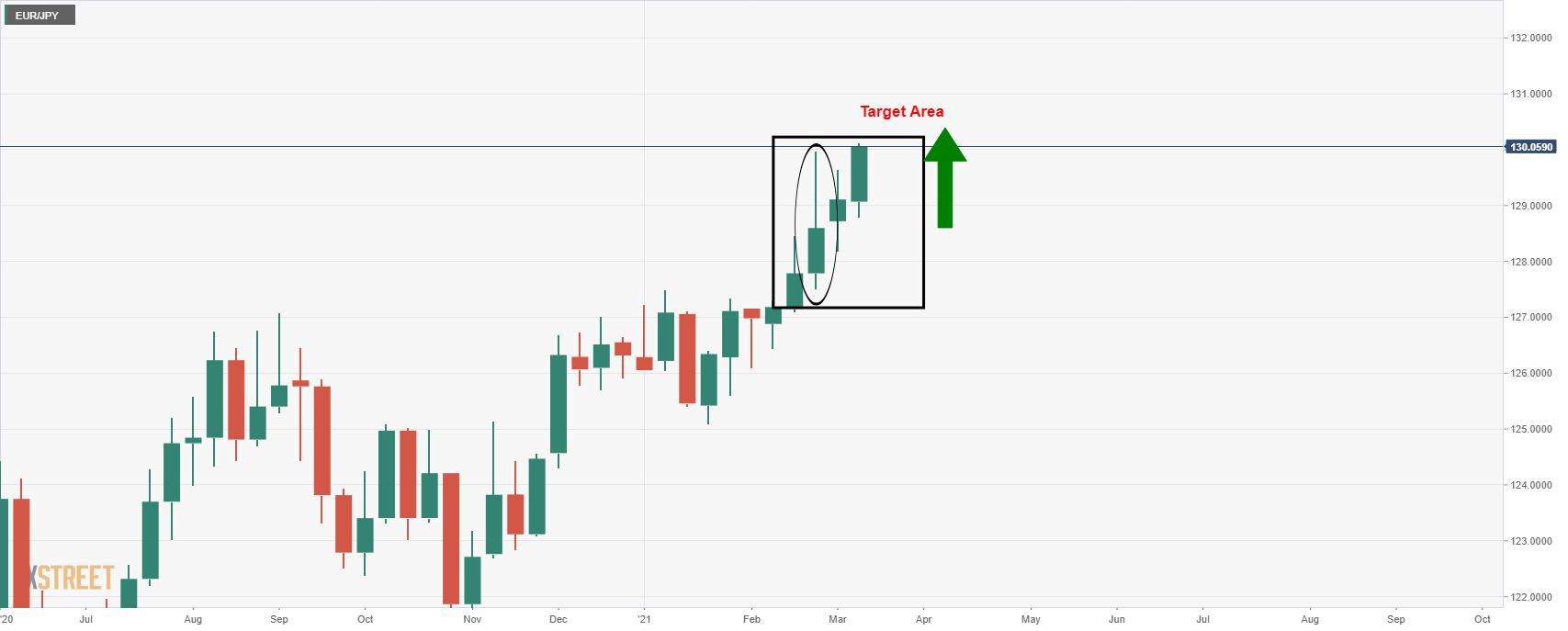

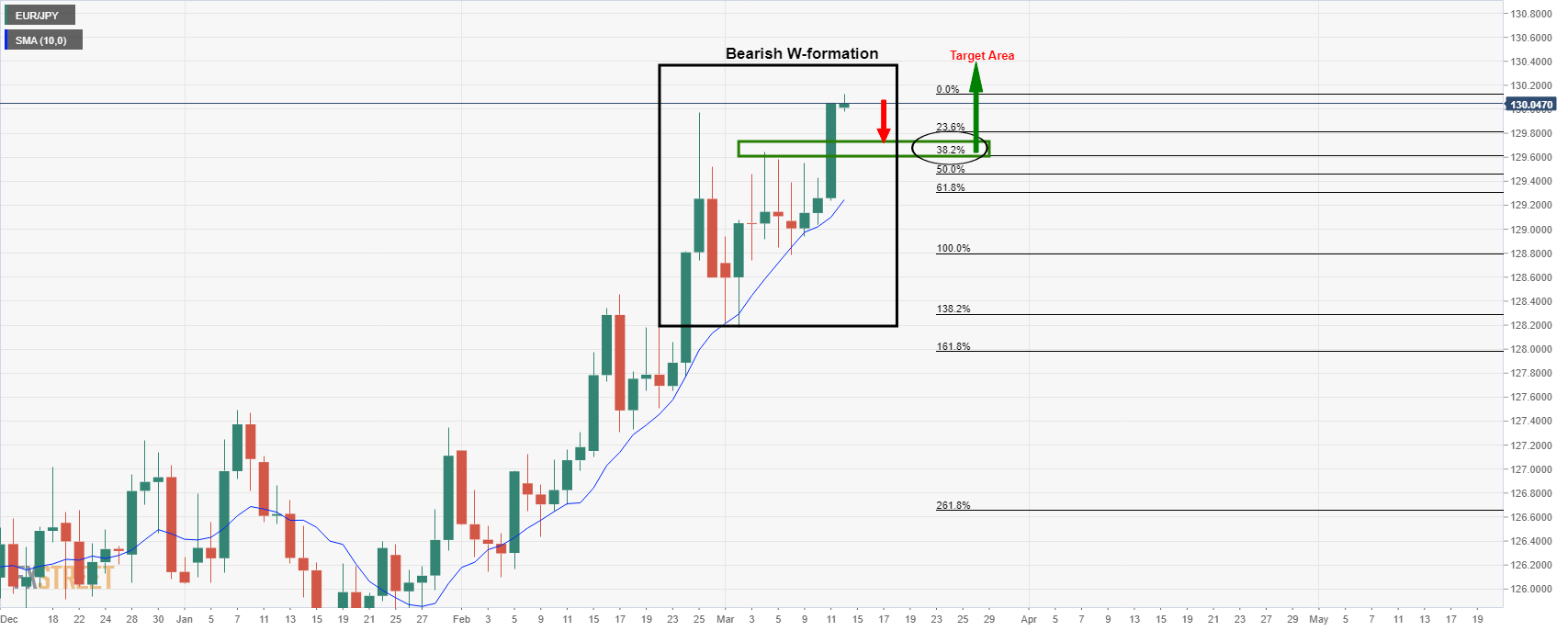

Meanwhile, there could some further commitments from the bears at this juncture and a 38.2% Fibonacci retracement to prior highs could be on the cards before further upside.

Daily chart

We have a risk in the W-formation on a daily which is a bearish pattern. The price could be due for a correction.

Traders have the option of taking profit in full or raising the stop loss to below a 50% mean reversion and the support structure, or a bit of both.

On the other hand, bulls may be inclined to keep 100% of the position open considering it is a risk-free bet at this juncture and stick to the trade plan’s target.