APPLE, Daily

Apple Inc, once again the largest company in the world by market capitalization, published better than expected Earnings for the vital October-December quarter after the markets had closed down significantly last night. The Apple share price closed down only -0.77% in anticipation of the results, compared to the wider loss on the Nasdaq (USA100) of -2.60%. Today with the wider market once again down, #APPL opened at 139.70. (TBC at 16:30)

The substantial quarterly Earnings that were reported after the market closed on Thursday were quite significant; revenues breached $100 billion for the first time, at $111.4 billion, ($8.36 billion more than the expected $103.1 billion) profits topped $11 billion and Earnings per Share were $1.68 compared with expectations of $1.42, to register an 18% beat. The iPhone maker’s market cap holds over $2.39 trillion. iPhone revenues accounted $65.6 billion versus expectations of $61.1 billion and the important services division $15.8 billion versus consensus of $14.9 billion and overall the products division beat estimates by over $7 billion, coming in at $95.68 billion.

The much-heralded iPhone 12 suite of phones seems to have been a significant success convincing a record number of people to switch to the company or upgrade from older models. As well as all divisions beating estimates, all global territories performed very well. Apple was a major beneficiary of the pandemic-driven tech boom of 2020 and the final quarter was no different. Sales in the firm’s greater China region, which includes Hong Kong and Taiwan, jumped 57%, and in Europe, sales rose 17%, while they rose 11% in Latin America. Apple now has 1.65 billion active devices, including over 1 billion iPhones.

Analyst Dan Ives of Wedbush Securities (a long time Apple bull) said he thought the firm was just at the beginning of a “super-cycle” as Apple devotees finally trade in old phones, coinciding with upgrades to telecommunications networks. “With 5G now in the cards and roughly 40% of its ‘golden jewel’ iPhone installed base not upgrading their phones in the last 3.5 years, [Apple chief Tim] Cook & Co have the stage set for a renaissance of growth” he wrote.¹

Looking forward, the Services and subscription platforms are becoming increasingly more important to Apple, and there is significant room for growth, however, design and hardware have always been integral to anything Apple has done in the past and with a huge potential new and existing user base (the Apple eco-system) still to upgrade to 5G, Apple is likely to remain iPhone focused for some years to come.

As the world’s largest company Apple has many diverse and varied investors – a look at its investor book shows 4 significant accounts holding 23.58% of the stock:

- Vanguard 7.61%

- Blackrock 6.36%

- Berkshire Hathaway 5.61%²

- State Street Corporation 4.00%

²The benefit of the Buffett long-term investing approach is that when he finds a winner, it can pay off handsomely. Apple (NASDAQ: AAPL) has been a huge winner for the Oracle of Omaha. Berkshire’s 944 million share stake in Apple makes up almost half of all of its publicly traded stock holdings, and it’s worth more than $135 billion at recent prices.

27 of the 40 active analysts following Apple have either a STRONG BUY or a BUY recommendation with only one of the 40 recommending SELL. Just this week upgrades have come from Morgan Stanley (Overweight) with Evercore, Raymond James Wedbush and Cowan & Co. all Outperform. Following last night’s data, target upgrades have appeared today from Credit Suisse ($140 from $120), Bernstein ($132 from $120), and RBC ($154 from $145). The current range for Wall Street runs from $80.00 to $175.

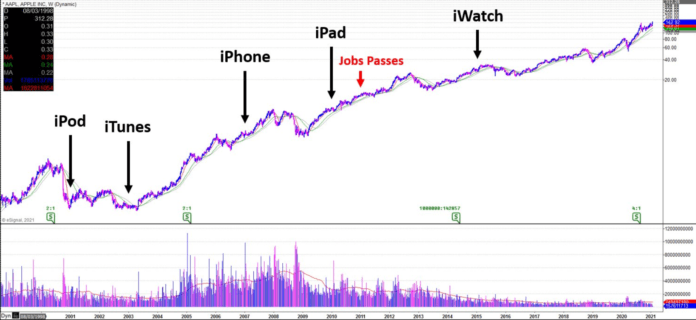

Apple continues to move forward on all fronts developing quickly and competitively in the new services sector. Over the years many have often called the top on Apple, but following last year’s stock split the company has attracted and retained new followers and investors and appears to have many years left as a growth stock and be far from hanging.