- AMC shares are up over 500% in 2021.

- The cinema leader has been boosted by sentiment not reality.

- The meme stock is trading at a lofty multiple for such an enormous debt pile.

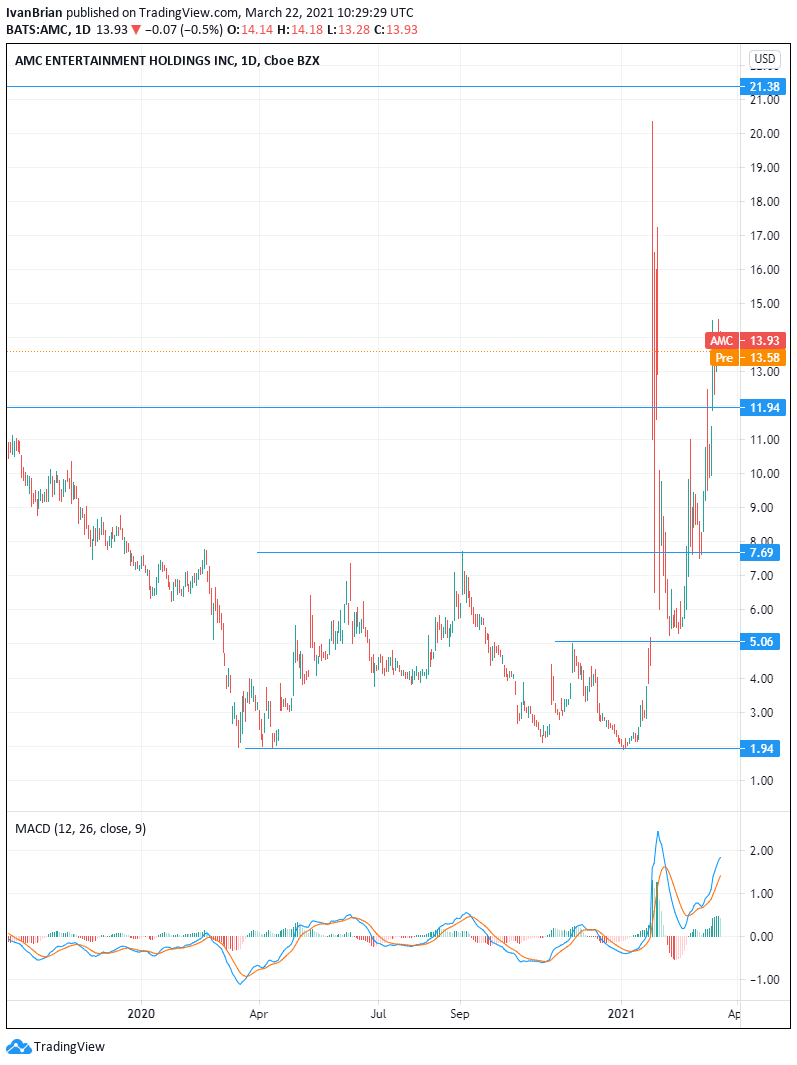

AMC shares have been one of the major trends of the US stock market so far this year, after experiencing stratospheric appreciation. AMC shares are up 557% year to date for 2021, and this is despite the sharp fall from January highs. The stock is up 152% in the last month alone.

AMC operates cinema theatres globally and understandably has suffered as a result of the pandemic. It operates in the US and Europe with theatres in 44 US states and 13 European countries.

Stay up to speed with hot stocks’ news!

AMC Stock News

The runner-up to GameStop in the r/WallStreetBets Reddit forum is in a strong cash position, having raised cash through debt, equity and asset sales during the crisis to fund future operations. In some respects, the spike in AMC shares on the back of strong retail interest may have helped the company to survive, as it enabled AMC to raise capital.

AMC secured more than $1 billion between April and November of 2020. It then took the opportunity to raise another $917 million in debt and equity between mid-December and late January of this year.

“This means that any talk of an imminent bankruptcy for AMC is completely off the table,” said Adam Aron, CEO and President.

Why is AMC stock going up? Well, because of this it meant that AMC would be able to survive the pandemic when many “shorts” were betting it would not. This led to a large spike in prices as AMC shares had to be bought back by shorts to cover their positions. The retail frenzy also reached a fever pitch in AMC and Gamestop around this time. All this led to a huge AMC share price rebound from below $6 to over $20 as retail traders piled into the stock.

Since then AMC shares have remained supported by the retail investment community, as AMC remains the first or second most trending stock on Twitter, r/WallStreetBets and other retail sites. The short interest remains high at 16%, but this has come down from over 30% in the early stages of the r/WallStreetBets short squeeze.

AMC stock forecast

AMC shares are way too high, there is no other way to be blunt about it. This is not investible in my opinion. Short-term traders can make money just from the price movement, but those expecting the shares to double or quadruple and remain there for the long term are highly likely to be disappointed.

The company nearly went bankrupt during the pandemic crisis but managed to raise cash to avoid that outcome. In doing so it has dramatically diluted shareholders by issuing fresh capital. AMC’s number of shares has nearly quadrupled during the pandemic crisis, and as the share price has appreciated AMC’s market capitalization has ballooned. It is now nearly trading at a record high valuation by market capitalization standards, as well as nearly every other metric.

AMC has a huge debt coming on the heels of its recent debt raise. The company has huge rents, which it has managed to defer. But these payments will soon become due as theatres open up. AMC in the good days of cinema-going struggled to make a profit as it was, which is why it was targeted by short sellers in the first place. The financial situation has worsened since then, more debt, more dilution. AMC would need to dramatically increase its revenue to meet increased debt repayments alone. AMC has $5.8 billion of debt to repay, up from $1 billion in 2019.

The corporation probably needs to reopen and sell out every cinema globally for every movie for every day going forward. And even then this may not be enough. 2019 was a high point in terms of revenue creation for AMC, but even then it could not turn a profit. It is hard to see what has changed. Demand may be pent-up, but not enough to backstop the current share price.

Too fast, too furious and too high for me. It does not make sense. Short-term investments do not need to make sense, but long-term investments do.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.