- Weekly closing above Nov 30 low offers a ray of hope for XAU/USD.

- The bearish bias remains intact until gold stays below 21-DMA.

- The recovery mode could extend into Asia’s weekly opening.

Gold (XAU/USD) staged an impressive bounce Friday, having hit the lowest in seven months at $1761 in the Asian trades.

Despite the corrective pullback, gold ended the week on a negative note, as the rally in the US Treasury yields undermined the sentiment around the non-yielding gold.

From a short-term technical perspective, it was critical for gold to close the daily candlestick above the November 30 low of $1765, in order to offer some reprieve to the bulls (as explained here).

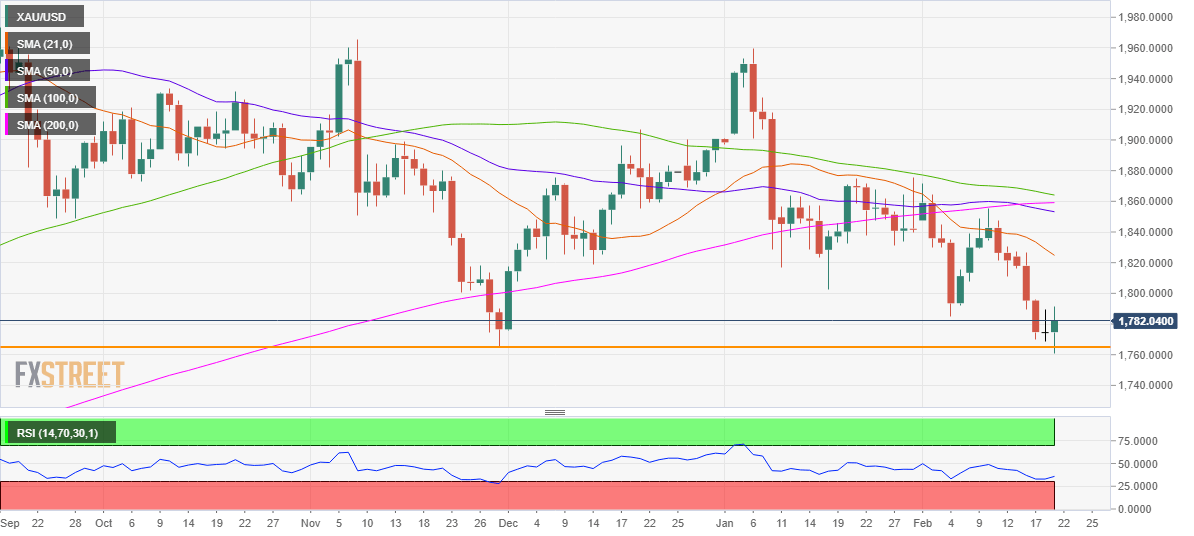

Gold Price Chart: Daily

Although, it may not negate the bearish bias as long as the price holds below the downward-sloping 21-daily moving average (DMA) at $1825.

Ahead of that level, the buyers need to find acceptance above the $1790 level, above which the January low of $1803 could be tested.

The 14-day Relative Strength Index (RSI) has bounced-off lows, still remains below the midline (the 50 level), indicating that additional recovery could be in the offing.

If the downtrend resumes, the seven-month troughs could be retested at $1761, opening floors towards the June 2020 low at around $1720.