- EUR/GBP stays mildly bid near intraday high, rises for the second consecutive day.

- Bullish MACD, sustained recovery from weekly low favor the bulls.

- BOE is likely to keep the monetary policy unchanged, signals for negative rates will be the key.

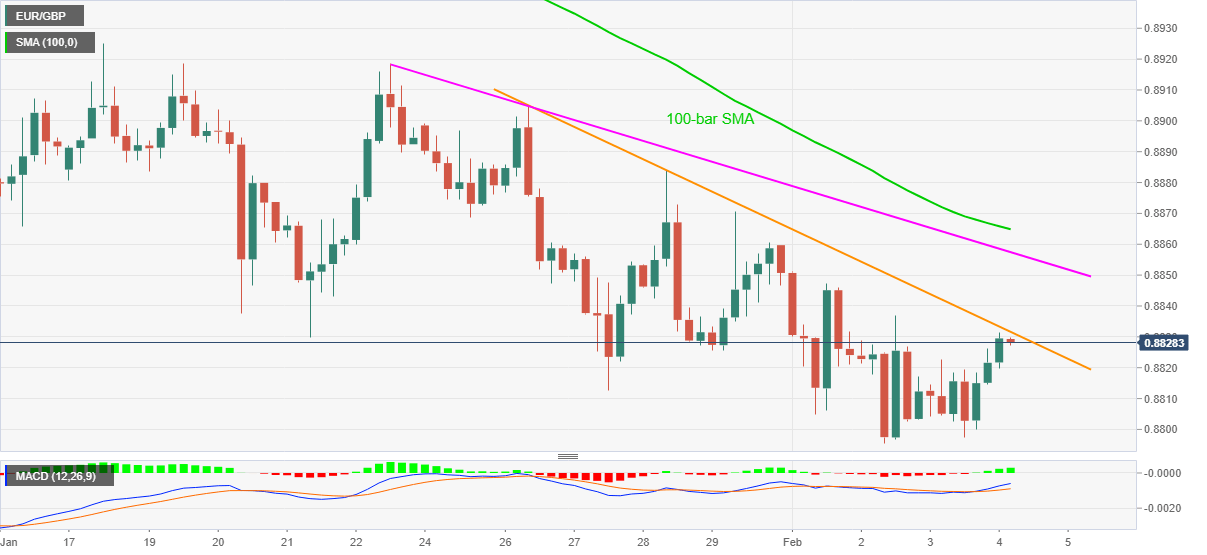

EUR/GBP takes bids near the intraday high of 0.8831 ahead of Thursday’s European session. The pair marked a corrective pullback during the last two days that currently battles a resistance line from January 26.

Although bullish MACD suggests the pair’s further upside, traders prefer waiting for the Bank of England’s (BOE) monetary policy decision, comprising quarterly events, for fresh impulse.

Read: Bank of England Preview: Bailey set to abandon negative rates, injecting sterling with new energy

Should the quote manage to cross the immediate hurdle near 0.8835, another falling trend line from January 22 and 100-bar SMA, respectively around 0.8860 and 0.8865, will be the key.

During the quote’s successful rise past-0.8865, the 0.8900, the 0.9000 psychological magnet and the previous month’s peak surrounding 0.9085 can lure EUR/GBP bulls.

Meanwhile, the latest multi-month low around 0.8795, marked on Tuesday, should stop the bears targeting the early March 2020 high near 0.8740.

In a case where the EUR/GBP prices remain weak below 0.8740, then the 0. 8700 round-figure and April 2020 low close to 0.8670 should gain the market’s attention.

EUR/GBP four-hour chart

Trend: Further recovery expected