Gold has been under pressure in recent days, hit most recently by news that AstraZeneca is joining Moderna and Pfizer/BioNTech in reporting upbeat vaccine results. If the world is heading toward immunization from COVID-19, the need for fiscal and monetary stimulus is diminishing.

On the other hand, the virus continues spreading, causing economic damage which could urge policymakers to act. Additional funds could eventually flow to the previous metal.

How is XAU/USD positioned on the technical charts?

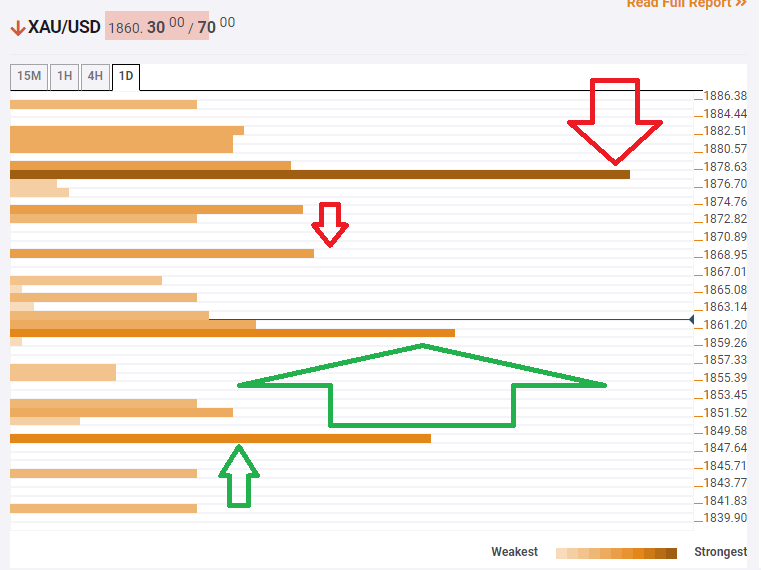

The Technical Confluences Indicator is showing that gold is close to the critical support at $1,860, which is where the previous month’s low and the Simple Moving Average 5-15min averages converge.

XAU/USD has another cushion at $1,848, which is the confluence of the Pivot Point one-month Support 1 and the Bollinger Band one-day Lower.

Looking up, the first hurdle is at $1,868, which is the meeting point of the SMA 5-4h, the SMA 100-15m, and the Fibonacci 23.6% one-day.

Critical resistance is at $1,877, a juncture including the Fibonacci 61.8% one-day and the Fibonacci 23.6% one-month.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence