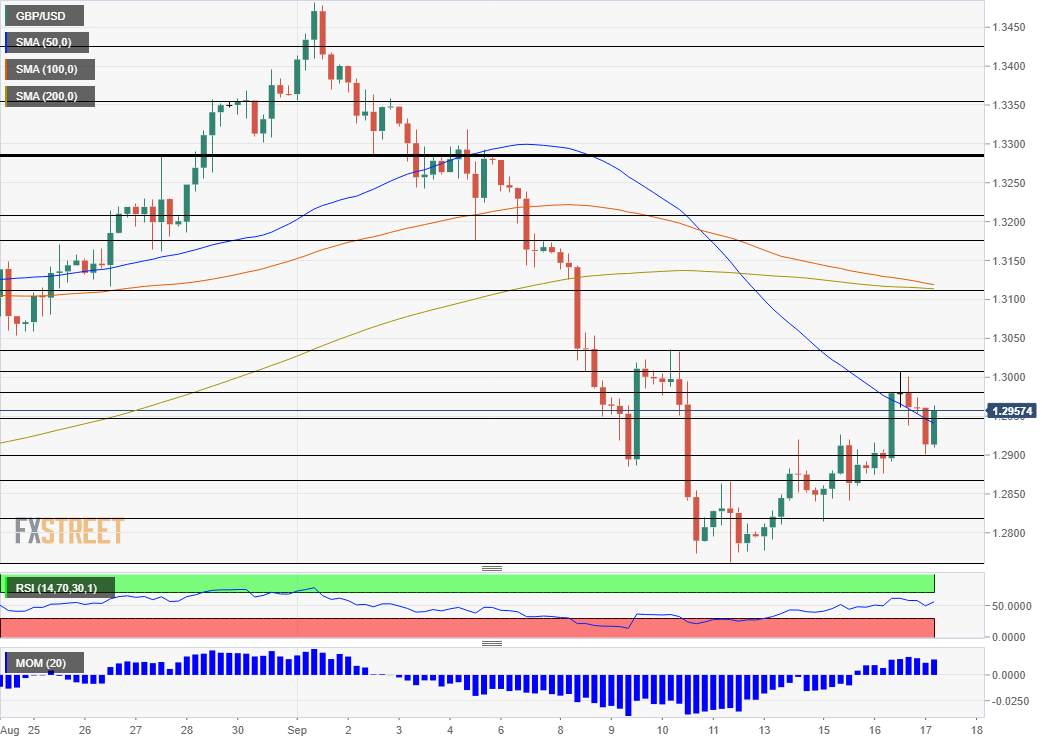

GBP/USD Forecast: BOE may compound the Fed and trigger greater downfall

The Brexit bonanza has proved short-lived – Pound bulls prematurely celebrated Prime Minister Boris Johnson’s climbdown before the Federal Reserve sent the safe-haven dollar higher. Now it is the Bank of England’s turn to move cable – and potentially tilt it lower.

PM Johnson agreed to compromise with the “rebels” in his Conservative Party by agreeing to more robust parliament oversight over the Internal Markets bill. This legislation – which is set to receive the House of Commons’ approval next week – knowingly violated the Brexit accord with the EU. Read More…

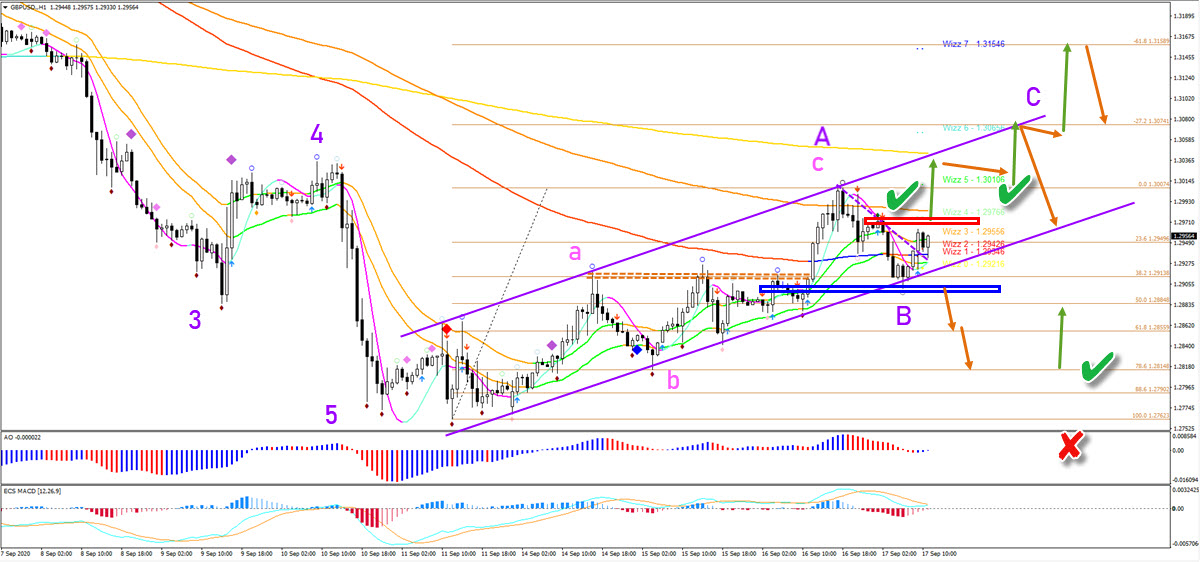

GBP/USD bulls regain control and aim at 1.3040 and 1.3150

The GBP/USD is building a well balanced uptrend channel. The bulls took over control when price broke through the resistance zone (dotted orange) and 144 ema. But can they push price action up higher?

The GBP/USD have the upper hand at the moment. And they are expected to keep it. A break above the resistance Fractal (red box) confirms the uptrend continuation. The main target is the long-term moving average and 38.2% Fibonacci retracement level of the 4 hour chart at 1.3040. Read More…

GBP/USD refreshes session tops, still below 1.3000 mark as focus remains on BoE

The GBP/USD pair managed to recover the early lost ground and was last seen trading near the top end of its daily trading range, around the 1.2970-75 region.

The pair witnessed some selling through the first half of the trading action on Thursday and extended the previous day’s retracement slide from the key 1.3000 psychological mark, or weekly tops. The US dollar added to the post-FOMC recovery move and got an additional boost from weaker global risk sentiment. This, in turn, was seen as a key factor exerting pressure on the GBP/USD pair. Read More…