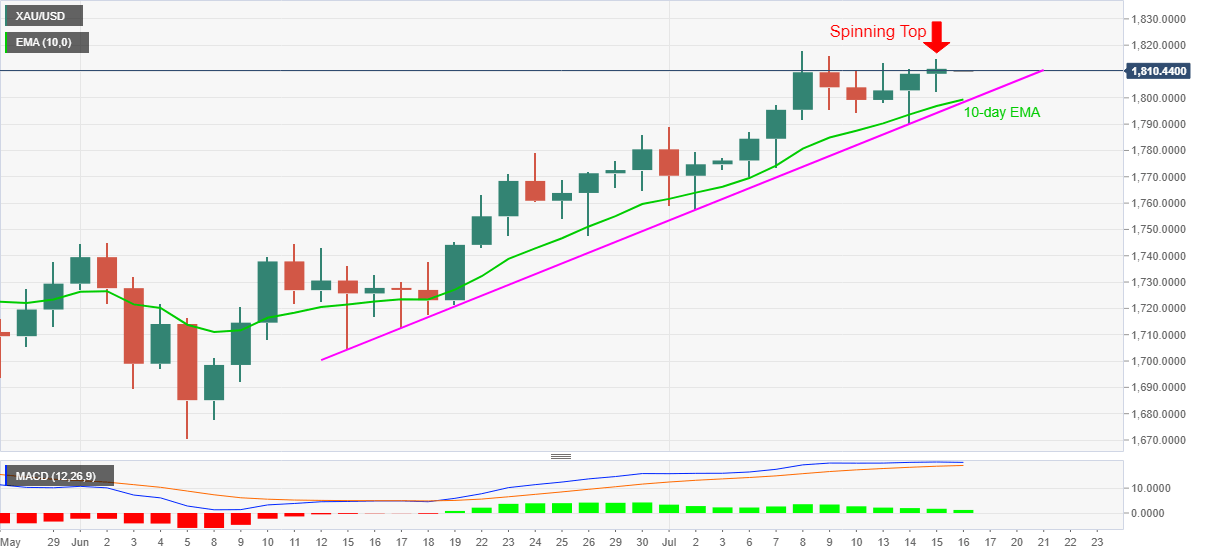

Gold Price Analysis: XAU/USD bulls stay hopeful above $1,800 despite Wednesday’s spinning top

Gold prices ease from one week high to $1,810 amid early Thursday morning in Asia. The bullion marked consecutive third positive daily closing the previous day. However, sluggish moves portray a “Spinning Top” candlestick formation suggesting traders’ indecision. The pattern joins the quote’s recent failures to refresh monthly high in suggesting the underlying weakness of the bullish momentum.

As a result, the bears could seek fresh entries targeting $1,800-$1,798 support area comprising 10-day EMA and an upward sloping trend line from June 15. However, any further weakness by the yellow metal will divert the bears towards July 01 top near $1,789.

Read more …

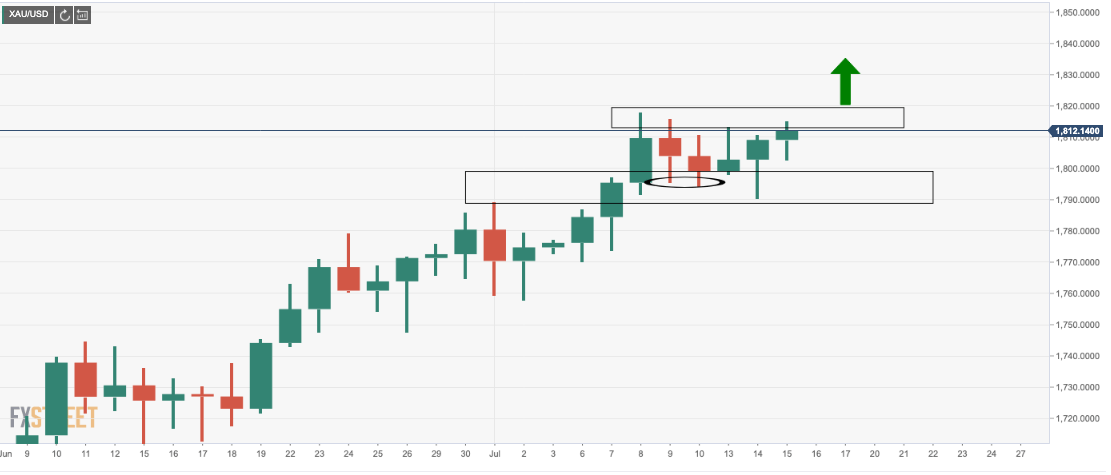

Gold prices march-on above a key support structure as inflation expectations ramp-up

Gold has made a mark on the $1,800 level, holding the support structure above $1,786/90 on a retest and pulling in commitments from the bulls. Inflation expectations and uncertainties remain the core fundamentals of the outlook.

We have seen risk markets improved on the back of promising vaccine results which tempered some of the bullishness out of gold momentarily. Meanwhile, US equities are a strong focus for this week considering the bank’s earnings.

Read more …